Covered California 1095-a Download

Should you have not received your 1095-A form, you can log onto your account in Covered California to download your 1095-A form or contact Covered California at 800-300-1506 or your agent who assisted you with the process of applying for health insurance over the exchange.

January 22, 2015If you or anyone in your household enrolled in a health plan through the Health Insurance Marketplace in 2014, this tax season you’ll get a new Form 1095-A — Health Insurance Marketplace Statement. You’ll get it in the mail by early February and use it to file your 2014 federal income tax return. Keep it with other important tax information, like your W-2 forms and other tax records.

When you get Form 1095-A, make sure the information matches your records. Check things like coverage start and end dates and the number of people in your household. If you think anything’s wrong, contact the Marketplace Call Center.

Get My 1095 A Online

What’s on Form 1095-A?

Covered California 1095-a Download

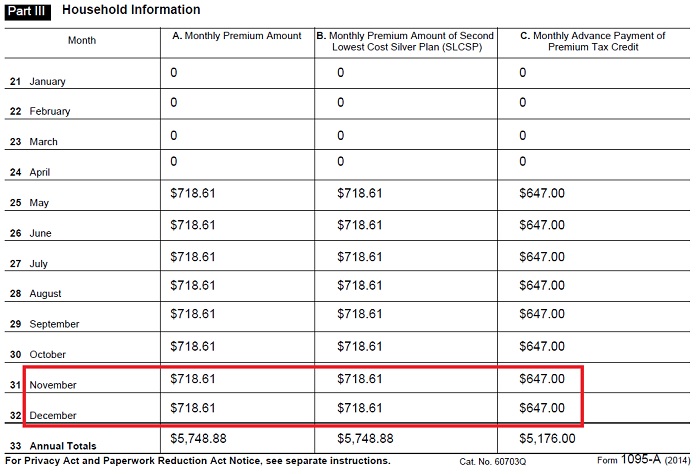

- Information about anyone in your household who enrolled in a health plan through the Health Insurance Marketplace for 2014.

- Information about the monthly premiums you paid to your health plan.

- The amount of any advance payments of the premium tax credit that were paid to your health plan in 2014. These are the credits that lowered what you paid in monthly premiums.

- The cost of a 'benchmark' premium that your premium tax credit is based on.You won’t get this form if you have health coverage through a job or programs like Medicaid, Medicare, or the Children’s Health Insurance Program (CHIP). You may get more than one Form 1095-A if anyone in your household switched plans in 2014 or reported life changes. You’ll get a Form 1095-A even if you had Marketplace coverage for only part of 2014.

You can download copies of Form 1095-A through your Marketplace account, where they may be available before you get your copy in the mail.

Need help? For more information about how health coverage will affect your taxes, visit HealthCare.gov/taxes/.

So I own a business and I'm finishing up my taxes in order to get a very nice refund for first year operating losses. However, because I never received my 1095-A form I can't finish the process.

I was able to track down the costs (total, premium, premium assistance), filling in the majority of the information. What I don't have is the 'Box 1 - Marketplace Identifier' and 'Box 2 - Marketplace Assigned Policy Number.' I called CC and my health insurer, both who couldn't help. I was informed to submit a dispute form to Sacremento which can take up to 60 days to process, extending beyond Tax Day and holding up a much needed refund.

So I'm wondering whether I should:

Final an extension and wait - hope - for the 1095-A to arrive some time near end of April and then wait another three weeks for my refund?

or

2) Write Not Available in both boxes, file my taxes, and if they ask for them, hopefully I will have received my 1095-A form by then, or I could say I never received it in the first place. I know this could hold up my refund, though.

Covered California 1095-a Download

I figure either way I'm waiting, but the second option provides a chance to receive my refund faster. The first option doesn't. Any assistance would be much appreciated!